If you're feeling overwhelmed by money worries, you are certainly not alone. Financial stress is one of the most common challenges people face today, and it can take a heavy toll on your mental health. The constant pressure of bills, debt, and an uncertain future can feel crushing. However, there is a path forward. By learning effective money management techniques and addressing the emotional side of finances, you can reduce anxiety, regain control, and find lasting peace of mind.

How do you know if your money worries have crossed the line into chronic financial stress? It often starts subtly, affecting your thoughts and behaviors in ways you might not immediately connect to your financial situation. Recognizing these signs is the first step toward addressing the root cause and protecting your mental health.

Taking an honest look at your personal finances and how they make you feel is crucial. Acknowledging the problem allows you to seek a solution instead of letting anxiety build. The following sections will explore the specific signs of financial distress and its deep connection to your daily well-being.

Financial anxiety can manifest in both emotional and physical ways. You might find yourself constantly preoccupied with thoughts about bills or your credit card debt, making it difficult to concentrate on work or enjoy your free time. This persistent money stress can feel like a heavy cloud hanging over your daily life.

This ongoing pressure often leads to noticeable changes in your behavior and health. These are not just minor worries; they can become serious health problems if left unaddressed. Some of the most common indicators that you are experiencing financial stress include:

If these signs sound familiar, it's important to understand that they are clear signals that your financial situation is impacting your well-being. Acknowledging these symptoms is a powerful first step toward finding a solution and reducing your financial stress.

The connection between your finances and your mental health is stronger than many people realize. Living with chronic stress from money problems can significantly increase your risk of developing depression and anxiety. A study from the University of Nottingham found that individuals struggling with debt are more than twice as likely to experience depression. This emotional toll can make it even harder to manage your finances, creating a difficult cycle.

This constant state of worry can also cause serious physical health problems. Financial stress has been linked to headaches, digestive issues, high blood pressure, and even heart disease. You might find yourself skipping doctor's appointments for fear of the cost, which only worsens potential health issues in the long run.

Ultimately, overwhelming financial pressure diminishes your overall quality of life. It can strain your relationships, isolate you from friends, and rob you of energy and self-esteem. Your daily life shouldn't be defined by financial worry. By addressing the stress, you can protect both your financial and personal well-being.

When you're feeling crushed by immediate financial pressure, finding short-term relief is essential for your peace of mind. While you work on long-term solutions, there are things you can do right now to calm your mind and reduce the intensity of your money worries. These techniques help you regain a sense of control when you feel powerless.

Taking a few moments to focus on your breathing or engaging in a simple, grounding activity can make a world of difference. The goal is not to solve every problem overnight but to give yourself the mental space to think clearly and tackle challenges without being overwhelmed. Let’s explore some of these instant stress-relief methods.

Mindful exercises are powerful tools for immediate stress relief because they pull your focus away from worrying about the future and ground you in the present moment. When you feel financial anxiety creeping in, practicing a simple relaxation technique can restore a sense of control and calm your nervous system. These exercises don't cost anything and can be done anywhere.

Taking just a few minutes each day to practice can significantly improve your mental health and quality of life. Consider incorporating these simple but effective mindful exercises into your routine:

These practices help interrupt the cycle of worry, giving your mind a much-needed break. They are not a substitute for a financial plan, but they provide the mental clarity needed to create one.

Beyond mindfulness, you can take small steps in your daily life to combat money stress as it arises. Sometimes, the best way to manage overwhelming feelings is to shift your focus to a simple, productive action. This helps you feel capable and in control, which can instantly improve your outlook.

Whether you're at home or in the office, these actions can help interrupt the stress response and improve your quality of life. They remind you that you have the power to influence your environment and your mood. Try one of these next time you feel stressed:

These small steps won't solve your financial problems, but they provide the immediate relief needed to face them with a clearer, calmer mind.

While immediate relief techniques are helpful, lasting peace of mind comes from taking practical steps to manage your money-related anxiety. This means moving from a place of worry to a position of action. Creating a clear financial plan is the most effective way to address the source of your stress head-on.

Effective money management involves understanding your spending habits, setting achievable financial goals, and building a system that works for you. By tackling your finances with a structured approach, you can turn feelings of helplessness into a sense of empowerment. The next sections will guide you through tracking your expenses and creating a budget.

The first step to gaining control of your finances is to understand exactly where your money is going. Tracking expenses might seem daunting, but it's an essential move toward building a realistic monthly budget. For at least one month, keep a record of every single purchase, from your mortgage payment to your morning coffee. This will reveal your spending habits and highlight areas where you can make changes.

Once you have a clear picture, you can prioritize your financial needs. Differentiate between "needs" (like housing, utilities, and groceries) and "wants" (like dining out, subscriptions, and entertainment). This isn't about denying yourself every pleasure, but about making conscious decisions that align with your financial goals.

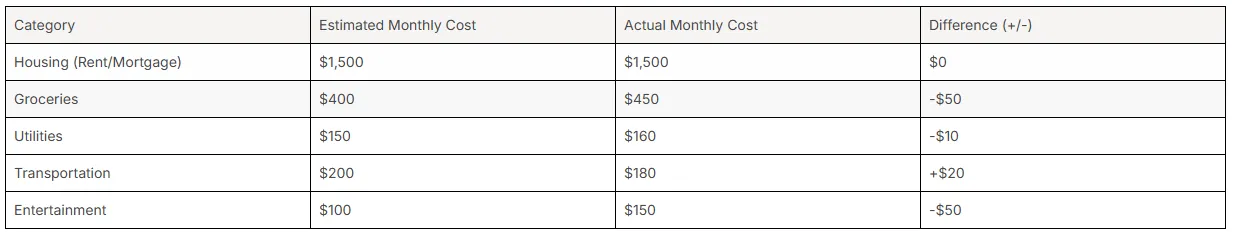

This simple exercise helps you regain control of your finances by providing clarity. A basic tracking table can help you get started:

Once you understand your spending, you can create a sustainable budget that works for your household in Houston, TX. A budget is simply a plan for your money. It ensures you can cover your needs, pay down debt, and start saving for the future. Start with your net income (after taxes) and subtract your essential expenses. The remaining amount can be allocated toward your financial goals, like building a savings account or paying off debt.

For residents of Houston, TX, financial planning should account for local costs of living, such as housing, transportation, and utilities. The key to a sustainable budget is to be realistic. If your budget is too restrictive, you're less likely to stick with it. Find a balance that allows you to make progress without feeling deprived.

A powerful daily habit is to review your spending at the end of each day. This takes only a few minutes but keeps you connected to your monthly budget and helps prevent small, impulsive purchases from derailing your progress. Automating transfers to your savings account is another great way to ensure you're consistently working toward your goals.

You don't have to face financial challenges alone. Building strong support systems is crucial for lasting stress relief and improving both your mental and financial health. Sharing your worries with a trusted friend or family member can make your problems feel less overwhelming and provide valuable emotional support.

Sometimes, you need more than a listening ear. Seeking professional counselling can provide you with practical tools and strategies to manage your finances and the anxiety they cause. The next section will explore where to find these valuable resources and how to start the conversation with those who can help.

If financial stress is overwhelming you, reaching out for professional help is a sign of strength. A financial therapist or counselor specializes in the intersection of money and emotions, helping you address the root causes of your financial anxiety. Similarly, a financial advisor can provide expert guidance on managing debt, budgeting, and planning for the future.

Mental health professionals are also equipped to help you develop coping strategies for the stress and anxiety caused by money problems. There are many affordable and free resources available to help you get started. Don't hesitate to use them.

Here are some places where you can find support:

In conclusion, managing financial stress is not just about finding quick fixes; it's about creating sustainable habits that contribute to your overall wellbeing. By recognizing the signs of financial anxiety, implementing immediate relief strategies, and building a support system, you can take proactive steps toward lasting peace of mind. Remember, seeking help from professionals and utilizing local resources can make a significant difference in your journey. If you're ready to take control of your financial stress, don't hesitate to reach out for personalized guidance. Together, we can work towards a healthier financial future!

Common signs of financial stress include persistent worry about money, difficulty concentrating, irritability, changes in sleeping or eating patterns, and avoidance of financial discussions. Recognizing these symptoms early can help you take steps towards managing your stress effectively.

Mindfulness can significantly alleviate financial stress by promoting awareness of thoughts and emotions related to money. Techniques such as meditation or deep breathing allow individuals to focus on the present, reducing anxiety and fostering a clearer perspective on financial challenges. Embracing mindfulness leads to informed decision-making.

To effectively manage money-related anxiety, begin by tracking your expenses and prioritizing financial needs. Creating a sustainable budget can also help alleviate stress, alongside seeking professional counseling tailored to your specific situation, ensuring you have the support necessary for lasting relief.

In Houston, TX, residents can access local resources like Riaz Counseling, which specializes in financial stress management. They provide personalized strategies and support to help individuals cope with anxiety related to finances and promote overall mental wellness.

If you feel that you or someone you know, may benefit from therapy, please reach out to our office for a FREE 15 minute consultation: LINK

Stay informed about the latest research in psychology.

.png)

Explore how Internal Family Systems (IFS) therapy heals trauma and restores self-leadership.

.png)

Explore how Internal Family Systems (IFS) therapy heals trauma, anxiety, and inner conflict.

.png)

A practical guide to recognizing, preventing, and healing teacher burnout in Houston schools.